Legacy display Course

This is an archived course. The content might be broken.

Practical lab in the winter semester 2015/2016:

Practical Lab Numerical Simulation - Computational Finance

| Under the direction of: | Prof. Dr. Michael Griebel |

| Date: | Wednesdays 14:15-15:45 |

| First meeting: | Wednesday, 21.10.2015, 14:15 |

| Place: | Room 6.020, Wegelerstr. 6 |

| Registration: | as from now by mail to Bastian Bohn, Jens Oettershagen |

Background

The precise and efficient valuation of financial derivatives, i.e. options, is of central importance to the finance industry. For plain vanilla European options the theory of Black, Scholes und Merton allows a quick and easy valuation. However, for practically relevant, more complex options, tools from computational finance are needed.

|

|

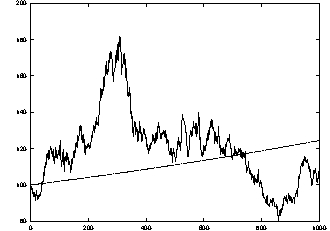

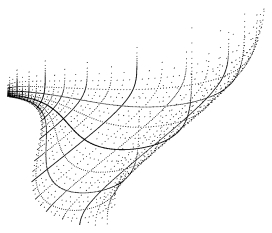

| Simulation of an asset price | Sparse grid used for integration |