Performance-dependent options are financial derivatives whose payoff

depends on the performance of one asset in comparison to a set of

benchmark assets. Typically, the more benchmark assets are outperformed,

the higher the payoff will be. Performance-dependent options are interesting

for two reasons: one motivation is pure speculation (similar to horse races as

depicted in the picture to the left), the second application comes from the

hedging of bonus programs.

Performance-dependent options are financial derivatives whose payoff

depends on the performance of one asset in comparison to a set of

benchmark assets. Typically, the more benchmark assets are outperformed,

the higher the payoff will be. Performance-dependent options are interesting

for two reasons: one motivation is pure speculation (similar to horse races as

depicted in the picture to the left), the second application comes from the

hedging of bonus programs.

Companies make big efforts to bind their staff to them for longer periods

of time in order to prevent a permanent change of executives in important

positions. Besides high wages, such efforts are long-term incentive and bonus

schemes. One widespread form of such schemes consists in giving

the participants a conditional award of shares. If the participant stays

with the company for at least a prescribed time period he will

receive a certain number of company shares at the end of the

period. Typically, the exact amount of shares is determined by a performance

criterion such as the company's gain over the period or its ranking among

comparable firms (the peer group). This way, such bonus schemes induce

uncertain future costs for the company.

It is now a huge risk for a company to leave this position unhedged.

The company could buy the maximum number of possibly needed shares at

the starting time of the scheme. This, however, would require a large

withdrawal of funds from the company's capital that could be put to better use.

The purchase of vanilla call options on the maximum number of possibly needed

shares is a smaller but still overdimensioned trade.

The appropriate financial instruments in this case are so-called

performance-dependent options. Such options simply

include the performance criterion in their contract.

The appropriate financial instruments in this case are so-called

performance-dependent options. Such options simply

include the performance criterion in their contract.

Using these options, the

company is able to purchase exactly the number of required shares at

the end of the scheme. Performance-dependent options minimize the amount of

money the company needs to hedge the future payments arising from the bonus

scheme. They can, when traded,

also be used for pure performance speculation purposes as a bet on the alpha

of a company or a fund manager (alpha certificates). This way profits can be

realized independently of the trend of the market.

In this project, we aim to define a framework for the efficient valuation of

fairly general performance-dependent options.

Thereby, we assume that the performance

of an asset is determined by the relative increase &Delta S = S(T) / S(0)

of the asset price over the considered period of time.

This performance is then compared to the

performances of a set of n-1 benchmark assets and saved in a vector Rank(S) ∈ { +, - }n

which contains n plus or minus signs and depends on the joint distribution of all

stock prices S = ( S 1 , ... , S n ).

A plus sign in the first component indicates that the stock price of our company is above the strike and

a plus sign in i-th component denotes that company i (which is the

(i-1)-th benchmark company) has been outperformed.

For each possible outcome R ∈ { +, - }n of the ranking

bonus factors, aR finally define the payoff of the option to its

holder. The payoff of the performance-dependent option at time T is

then given by

We use a multidimensional Black-Scholes model

for the temporal development of all asset

prices required for the performance ranking.

If the number d of stochastic

processes in the model equals the number n of companies we speak of a full

model. In the case d < n, we call the model reduced.

Reduced models arise by grouping companies to sectors or

via principal component analysis of full models.

We use a multidimensional Black-Scholes model

for the temporal development of all asset

prices required for the performance ranking.

If the number d of stochastic

processes in the model equals the number n of companies we speak of a full

model. In the case d < n, we call the model reduced.

Reduced models arise by grouping companies to sectors or

via principal component analysis of full models.

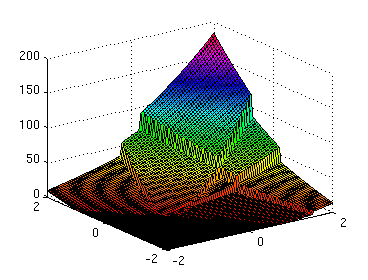

A performance depending option with 5 companies which pays a bonus which

increases linearly with the number m of outperformed benchmark companies is defined for instance

by the bonus factors

aR=m/4.

In this case the payoff thus only depends on the number of plus signs in the ranking

vector aR which defines the rank of our company in the benchmark.

If the company ranks first there is a full payoff

(S1(T) - K)+. If it ranks last, the payoff is zero.

The payoff of this option in case of a reduced model with two

stochastic processes X1 and X2 is displayed in the figure above.

Note that the payoff function is typically divided into several regions where

each region corresponds to a different ranking. Between these regions the payoff

function is discontinuous due to the jumps in the bonus factors.

The structure of the discontinuities in the payoff function above is displayed in the figure left.

One can see that the underlying geometry is described by an hyperplane arrangement which contains

n=5 (hyper-) planes in the d=2 dimensional space.

Within the above setting the martingale approach yields the fair price of the

performance-dependent option as a

multidimensional integral whose dimension is the number of stochastic processes

used in the model. Unfortunately, in the full-model case as well as in

the reduced one there is no direct closed-form solution for this

integral. Moreover, the integrand is typically

discontinuous which makes accurate numerical solutions difficult to achieve.

Within the above setting the martingale approach yields the fair price of the

performance-dependent option as a

multidimensional integral whose dimension is the number of stochastic processes

used in the model. Unfortunately, in the full-model case as well as in

the reduced one there is no direct closed-form solution for this

integral. Moreover, the integrand is typically

discontinuous which makes accurate numerical solutions difficult to achieve.

In this project, we investigate the derivation of closed-form solutions

to these integration problems.

Our general approach is to decompose the integration domain into regions

where the payoff function is smooth (see the figure above).

While these regions, which are defined by the underlying hyperplane arrangement,

are easily found in the full model case, tools

from computational geometry have to be used in the

case of reduced models. Moreover, the integration regions may be

defined by general polyhedra in the d-dimensional space.

To handle this more complicated geometry we decompose the regions

further into simple so-called orthant regions.

This is possible by using exactly one orthant per polyhedron as illustrated in

the figure to the right for a hyperplane arrangement with three planes. Here, three polyhedra

P1, P2 and P3

are decomposed into a signed sum using the three orthants

O1, O2 and O3.

This strategy not only works in the shown two-dimensional example but also for general dimensions and an arbitrary number of benchmark companies. The decomposition algorithm is based on the Lawrence signed decomposition lemma and uses the fact that every hyperplane arrangement can be decomposed into orthants by using exactly one orthant per cell.

These valuation formulas can be seen as multivariate generalizations of the classical Black-Scholes formula for performance-dependent options. In practice, the formulas allow a fast end efficient computation of option prices even for large benchmarks.