Numerical Quadrature in Finance

Description

Multivariate integrals arise in many application fields, such as statistics,

the valuation of financial derivatives, the discretization of

partial differential and integral equations or the numerical computation

of path integrals. Conventional algorithms for the numerical computation

of such integrals are often limited by the

curse of dimension meaning

that the computing cost grows exponentially with the dimension of the problem.

However, for special function classes, such as spaces of functions which

have bounded mixed derivatives, Smolyak's construction (also known as sparse

grid method) can overcome this curse of dimension to a certain extent. In this

approach, multivariate quadrature formulas are constructed using combinations

of tensor products of suited one-dimensional formulas. In this way, the number

of function evaluations and the numerical accuracy get independent of the

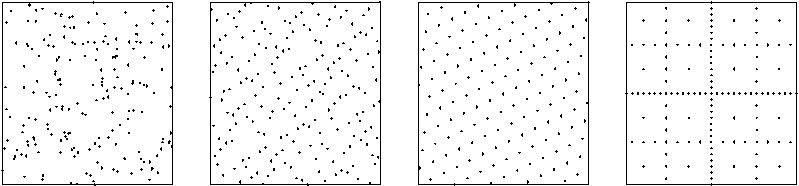

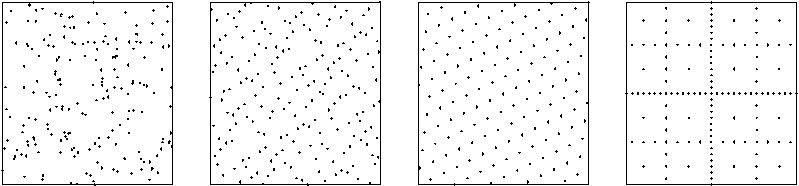

dimension of the problem up to logarithmic factors. Below you see the

quadrature abscissas from a Monte Carlo and a Quasi-Monte Carlo method, a

lattice rule, and a sparse grid, all of which can break the curse of dimension.

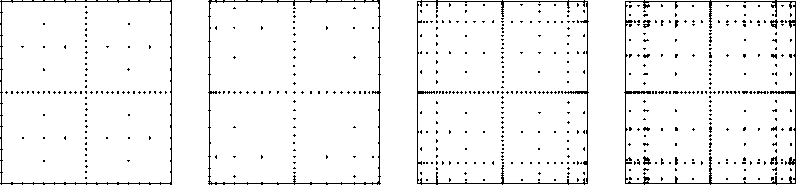

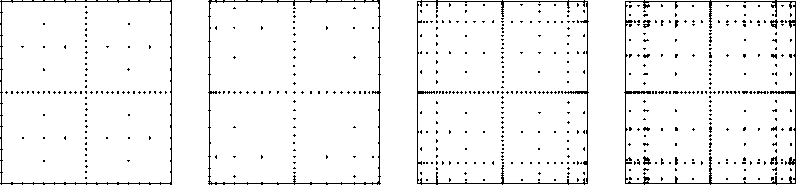

Sparse grid quadrature formulas come in various types depending on a

one-dimensional basis integration routine. In the next picture we see sparse

grids based on the trapezoidal, the Clenshaw-Curtis, Patterson and Gauss-Legendre

rules. Theoretical and experimental computations have shown that Patterson

formulas are sort of optimal for Smolyak's construction.

The scope of this project is to apply sparse grid quadrature formulas

to various problems from finance. These problems

typically require the computation of expecations, which are integrals whose

dimension is infinite for continuous processes and finite but high for

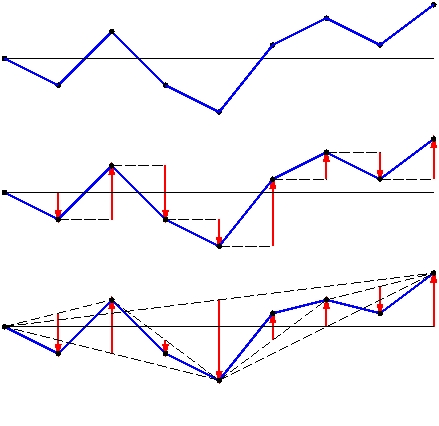

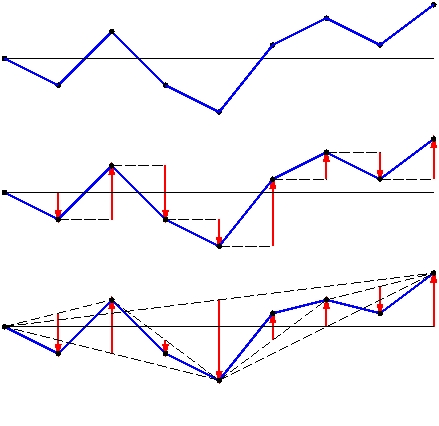

discrete processes. The Brownian bridge construction helps to reduce the

effective dimension of these integrals. Below, you see a sample random process,

and corresponding discretizations using a random walk and the Brownian

bridge construction.

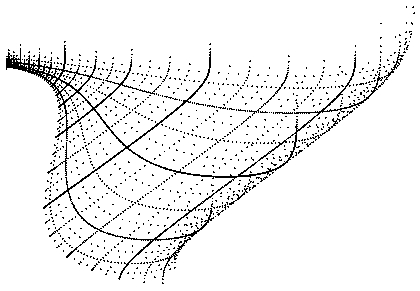

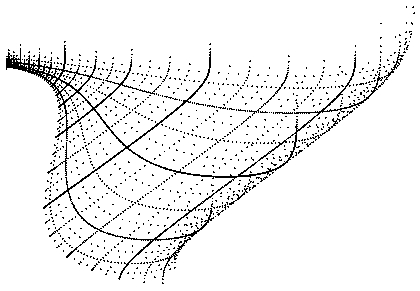

Below, you see the location of the integration points for two-step geometric

Asian option. Here, in order to avoid the discontinuity in the derivative

of the (transformed) payoff function, the integration domain was transformed

to the smooth nonzero part of the payoff function.

References

-

T. Bonk, A new algorithm for multi-dimensional adaptive numerical

quadrature, in Adaptive Methods - Algorithms, Theory and Applications,

W. Hackbusch, G. Wittum (eds.), pp. 54-68, Vieweg, Braunschweig, 1994.

-

T. Gerstner, M. Griebel,

Numerical integration using

sparse grids, Numerical Algorithms 18:209-232, 1998.

-

T. Gerstner, M. Griebel,

Dimension-adaptive

tensor-product quadrature, Computing (special issue on sparse grids),

2002, submitted.

-

T. Gerstner, M. Griebel, S. Wahl, Option pricing using sparse

grids, 2001, available on request.

-

E. Novak, K. Ritter, High dimensional integration of smooth functions

over cubes, Numerische Mathematik 75, pp. 79-97, 1996.

-

S.A. Smolyak, Quadrature and interpolation formulas for tensor

products of certain classes of functions, Dokl. Akad. Nauk SSSR 4,

pp. 240-243, 1963.

-

The Sparse Grid

Bibliography.

Related Projects